SWEEP is unpermissioned. Users can get it through AMMs on many EVM chains.

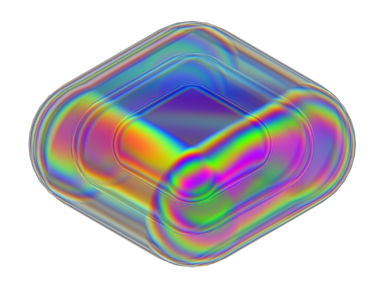

Sweep fits into DeFi, self-custody wallets and AMMs. It requires no rebasing or staking. Built for long-term embedding, it adjusts allocations to CeFi and DeFi as the business cycle changes

Users have real-time visibility into asset allocation, capital buffers, flows, and pricing. This adds responsiveness in times of stress. Governance is open and visible. The protocol gains capability and redundancy through proposals from borrowers.

Sweep is optimized for funding tokenized securities. It supports custom DeFi strategies that are liquid, dollar denominated, and protected by equity to cover value at risk.

Managers can target minimum ROE of 25%+. Managers can close their positions at any time.

Apply to get margin funding for new assets and custom DeFi strategies.

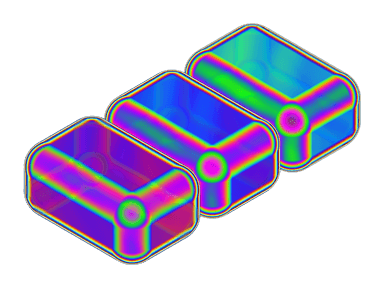

Designed for L2s

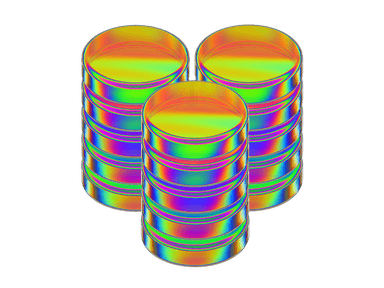

Grow the on-chain economy.

A growing on-chain economy will improve transparency, access, and innovation for financial services users. We plan our contribution in steps:

Keep dollars on-chain

Stablecoin holders are redeeming about $500M per week, and moving to off-chain money market funds. Sweep gives them more reliable ways to hold assets on-chain.

Fund on-chain securities

Sweep protocol provides margin funding for on-chain securities such as tokenized treasuries. It bridges from open access and real-time liquidity, to restricted securities that require up to 7 days for trade settlement.

Add economic value and revenue

Support economic growth and bring revenue on-chain with architecture for real-world asset investment.